Over the past few years, consumers are having easier payment experiences with contactless mobile payments and many other options like digital wallets, UPI, and payment apps. This makes the burgeoning growth of the B2C market obvious.

But what about B2B payments?

The increasing use of digital channels and automation across different industries have lifted the expectations of B2B customers who now look for more convenient, secure, and seamless transaction experiences. Especially, with the emerging trends of blockchain, AI, cryptocurrency, automation, and virtual cards, the B2B payment market is headed towards a disruption, including the cross-border digital payment market.

It is interesting to know that B2B market is already on the path of exponential growth with an expected CAGR of 10.6% from the year 2020 to 2028. The market size of B2B payments was valued at $870.42 in 2020 and is expected to reach $1.91 trillion by 2028.

| What’s Changing in B2B Payments? |

| 42% increase in online transaction volume reported by small and medium-sized US B2B businesses in 2020. |

| Digital AR Systems are replacing the manual AR (Account Receivable) processes which have 30% longer Days Sales Outstanding. |

| 85% of banks believe that real-time payments are the foundation for growth in B2B segment. |

| Real-time payments are becoming more commonplace and are driving the adoption of international standards (ISO 20022) while fuelling new innovations. |

| Ecommerce is one of the top industries driving digital B2B payments. |

1. Ecommerce: A major driver for B2B payments

Millennials make the top decision-makers today who wish to receive and offer a seamless payment experience to all including their customers, suppliers, partners, or manufacturers. It will make their operations faster, automated, paperless, accurate and easy to execute. Businesses are driving other businesses to adopt digital payment and lubricate the entire system for a smooth flow of digital cash.

2. AP (Account Payable) and AR (Account Receivable) automation will witness a boom

Businesses still dealing with manual processes spend 67% more time in following up for overdue payments on an average than others who have an automated AR system in place. Is that not a setback for your efficiency?

Though investments in automated payment technologies were there for quite a long, the thrust on automation is quite high these days considering the benefits it brings. Such automation will ensure better cash management and payment strategies.

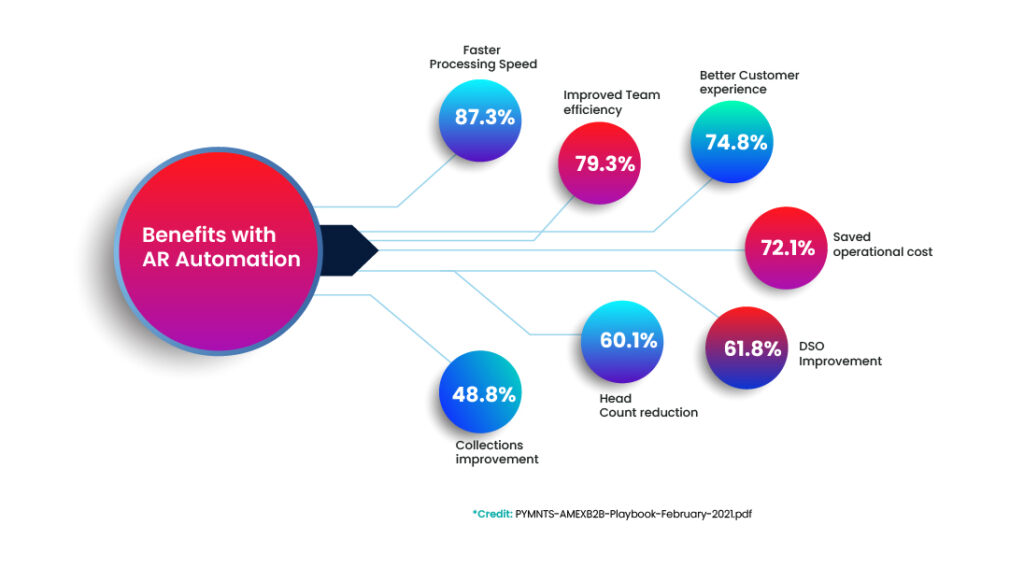

Benefits with AR Automation

*Credit: PYMNTS-AMEXB2B-Playbook-February-2021.pdf

3. Vanishing trend of cheques

US is one of the heavy cheque-using countries with more than 50% of their transactions done through cheques. Though they still dominate the market, a 3.7% decline in commercial usage is projected by Federal Reserve.

85% of banks believe that real-time payments are the foundation for growth and businesses are rapidly shifting from cheque payments to electronic payments. This is going to be a momentous drive in B2B payments in the coming days.

4. Use of Virtual cards on Boom for Commercial Payments

Suppliers, distributors, and businesses in general, struggle hard when it comes to getting paid faster. This is leading to a widening interest among companies for virtual cards which will enable them to have a faster collection and improved working capital.

Not only this, the use of virtual cards offers the highest level of protection against fraud as compared to the use of paper cheques.

Payment frauds through virtual cards accounted only 3% of the total transactional frauds as against 74% done through the paper cheques. Virtual card spend which stood around $213.8 billion in 2021 is projected to be around $414.2 billion in 2024. |

5. ACH Payments Expected to Grow

Cards, cheque and ACH usage run closely with ACH dominating the core payment system for too long. In the same lines, a recent research reveals an increase of 69.25 percent in the ACH transaction value which reflects a growth of 1.78% per year since 2018.

This spike is attributed to consumers and businesses making more ACH payments directly and partially due to ACH being used as a settlement vehicle for a variety of small-value payments.

The trend will continue to grow with small businesses and SMEs pushing ACH payments for B2B transactions.

6. The need and preference for real-time payments

Real-time payment in B2B segment is seen as a highly secure and scalable option. This ensures efficiency in e-invoicing, billing, and payment collection leading to better cash flows and liquidity management.

This is being welcomed with open hands by businesses of all sizes to reduce any capital risk and to respond to the need of technological innovations.

Real-Time Payments Bring More Than the Speed of the Payment

Apart from absolute immediacy in payments, the other greatest advantage is the powerful unlocking of shared data.

7. Cryptocurrency receiving the daylight

Businesses are keeping an eye on the development of crypto currency in B2B market. Though the adoption rate is not too high, businesses have moved to Cryptocurrency in B2B landscape, with major industry players like Mastercard bringing it to their network.

With Biggies entering this space, more choices would be offered to customers and businesses to move digital value. The potential growth in cryptocurrency is inevitable.

Though businesses have been making payments to businesses for ages, the current scenario is being pushed by the need for electronic B2B payments through various modes.

Monay offers out-of-the-box solutions and an exclusive payment journey for small, midsize, and enterprise-level businesses with customizable platforms. Through ongoing research & development, forward-thinking capabilities, and strategic partnerships, we aim at shaping the future of business payments – making them faster, secure, and more intelligent.

Whether you’re an established company or just starting out, processing B2B payments and communicating with your customers will never be easier than this.

References:

B2B Payments Market Size, Share and Analysis | Forecast – 2031 (alliedmarketresearch.com)

Alibaba.com Eyes SMBs’ Digitization Momentum | PYMNTS.com

PYMNTS-AMEXB2B-Playbook-February-2021.pdf

business-payments-2022-whitepaper.pdf (mastercard.us)

business-payments-2022-whitepaper.pdf (mastercard.us)