While vendors submit invoices along with goods or services, they look for timely payment.

Every organization is trying to manage vendor payments based on cash flow, however many organizations are now moving towards disciplined “Revenue Management” that includes both pay-in and pay-out. Most of the businesses, online or offline, have implemented advance payment or pre-paid models for better cash flow. We are also witnessing that the same organizations are trying to have effective vendor management and they are implementing compliances & policies on “Timely Payment”.

Vendor payout, also referred to as supplier payments, form an indispensable component of business-to-business (B2B) payment and represents the conclusive phase of the purchase-to-pay cycle for any organization. This essential process entails financial transactions executed by a business enterprise to compensate external suppliers or vendors for goods or services procured from them. Given its criticality, it is imperative that vendor payout processes are seamlessly executed, meticulously managed, and structured in a manner that is feasible for the organization, thereby guaranteeing a healthy rapport with the vendor ecosystem.

Though vendor payments are an integral part of any business, there exist several problems and associated challenges that linger the entire process. A few of these problems are listed below.

To address these problems, businesses need a comprehensive approach that includes implementing vendor payment automation, choosing the right payment methods, and establishing clear communication channels with vendors.

Building and maintaining strong relationships with suppliers and vendors who provide goods and services is crucial for any business to thrive. By implementing effective vendor management strategies, you not only improve supply chain efficiency but also reduce costs. When it comes to managing vendors, one of the most crucial aspects is timely and accurate vendor payment. Ensuring that invoices are verified and approved by authorized personnel, payment information is accurately recorded, and accounts are reconciled, can go a long way in establishing trust and maintaining a positive relationship with your vendors.

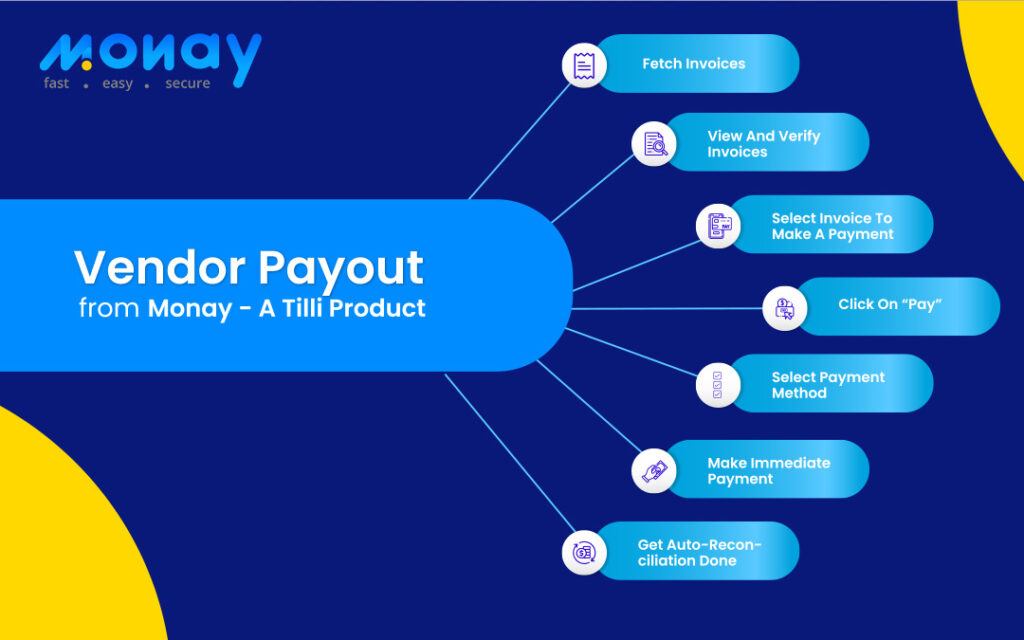

Here are the key steps involved in vendor payment process:

Negligence or error in any one of these steps may lead to distrust and loss of your brand reputation. This is where vendor payment automation comes to rescue offering you a smooth payment processing workflow, for payments of all sizes.

If you are dealing with multiple vendors preferring different payment methods, Monay is just the right platform for you to simplify and streamline your vendor payout process.

At Monay, we offer a single-platform solution allowing seamless and efficient vendor payment management that saves time and reduces errors.

Streamline your B2B payment process effortlessly with Monay’s vendor payment solution, featuring a user-friendly interface for easy invoice processing, real-time tracking of payments, customizable approval workflows, and automated accounting tasks.

Let us help you make your vendor payout an easier and more efficient experience with Monay, a Tilli Product.